Compare Pet Insurance Quotes Now

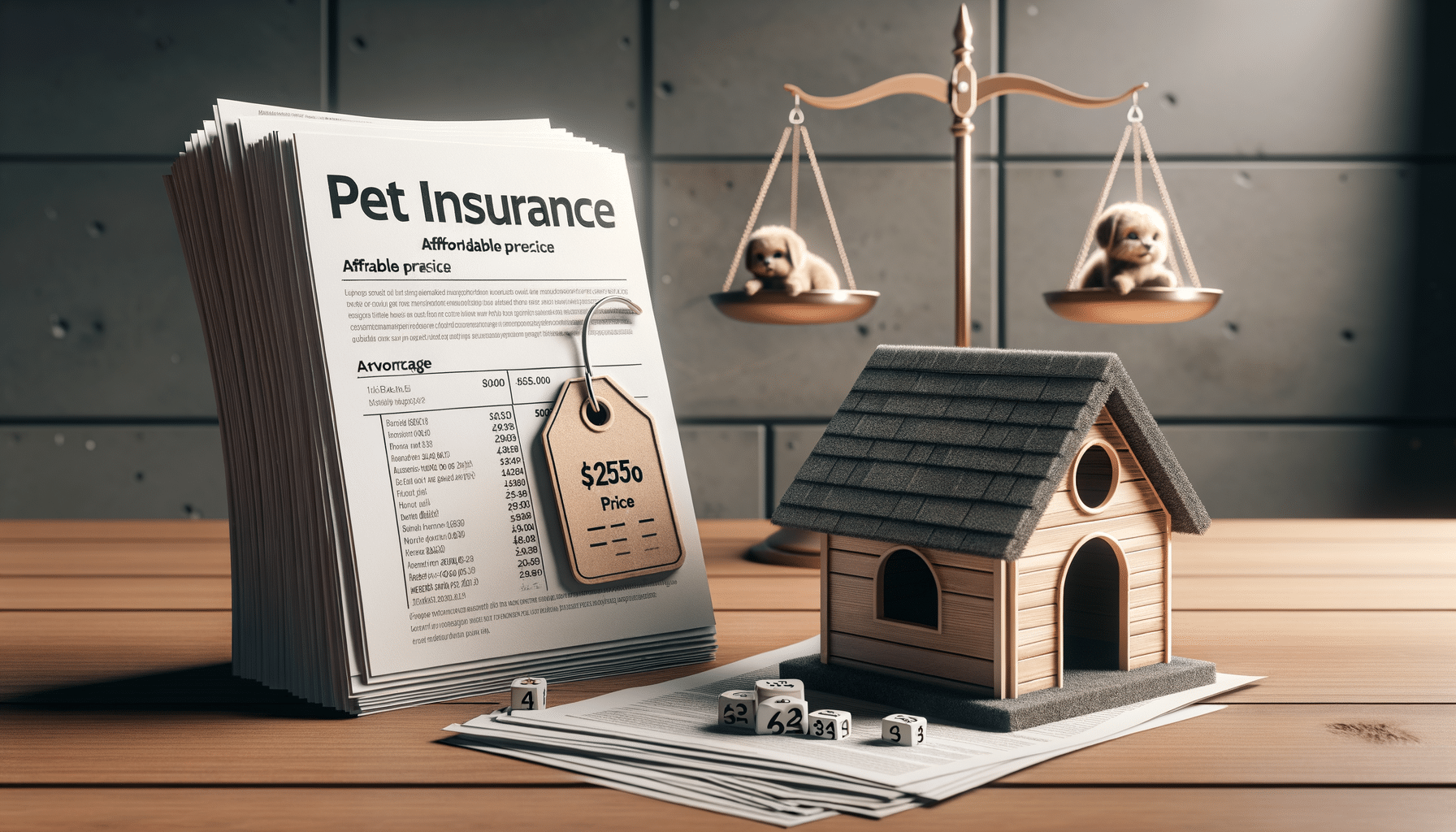

Introduction to Pet Insurance

As a pet owner, ensuring the health and well-being of your furry friend is a top priority. With the rising costs of veterinary care, having a reliable pet insurance plan can be a financial lifesaver. Pet insurance provides a safety net for unexpected medical expenses, allowing you to focus on your pet’s recovery rather than the cost. In this article, we will explore how to compare pet insurance quotes effectively, understand coverage differences, and uncover tips for cost savings.

Understanding Pet Insurance Quotes

When it comes to securing pet insurance, obtaining quotes is a crucial step. Pet insurance quotes give you an idea of the potential cost and coverage options available. To get accurate quotes, you need to provide details about your pet, such as age, breed, and any pre-existing conditions. It’s important to note that quotes can vary significantly between providers due to different underwriting criteria and policy terms.

Here are some factors that influence pet insurance quotes:

- Breed: Certain breeds are more prone to specific health issues, which can affect the quote.

- Age: Older pets may have higher premiums due to increased health risks.

- Location: Veterinary costs vary by region, impacting the quote.

- Coverage Type: Comprehensive plans with more benefits tend to have higher premiums.

By comparing pet insurance quotes, you can identify a plan that fits your budget and meets your pet’s needs. Remember, the cheapest quote isn’t always the best option; consider the coverage details carefully.

Coverage Comparison: What to Look For

Pet insurance policies can vary widely in terms of coverage. It’s essential to understand what each policy offers to make an informed decision. Key elements to compare include:

- Accident Coverage: Most plans cover accidents, but the extent of coverage can differ.

- Illness Coverage: Check if chronic and hereditary conditions are included.

- Wellness Coverage: Some plans offer routine care coverage, such as vaccinations and dental cleanings.

- Exclusions: Be aware of any exclusions, such as pre-existing conditions or specific treatments.

By evaluating these factors, you can determine which plan provides the most comprehensive coverage for your pet. It’s also beneficial to read customer reviews and ratings to gauge the satisfaction of current policyholders.

Cost Savings Tips for Pet Insurance

While pet insurance can be a valuable investment, finding ways to save on premiums is always welcome. Here are some tips to help reduce costs without compromising coverage:

- Choose a Higher Deductible: Opting for a higher deductible can lower your monthly premium.

- Bundle Policies: Some insurers offer discounts if you bundle pet insurance with other types of insurance.

- Maintain a Healthy Pet: Regular check-ups and a healthy lifestyle can prevent costly health issues.

- Compare Regularly: Re-evaluate your policy annually and compare quotes to ensure you’re getting the best deal.

By implementing these strategies, you can make pet insurance more affordable while ensuring your pet receives the necessary care.

Conclusion: Protecting Your Pet’s Future

Pet insurance is a practical way to safeguard your pet’s health and your finances. By taking the time to compare pet insurance quotes, understand coverage options, and apply cost-saving tips, you can find a plan that offers peace of mind. Remember that each pet is unique, and their insurance needs may change over time. Regularly reviewing your policy ensures that your pet remains protected as they grow and their health needs evolve.

Ultimately, investing in pet insurance is investing in your pet’s future, allowing you to provide them with the care they deserve without financial strain.